The final major hurdle to normal life in the USA for us has been credit. We don’t need credit, or particularly want it, but there’s a limit to what you can do without it. Without a credit history, cell phones are more expensive (if you buy them from a store, but really who does that?), you can’t do things like buy a house, and if an emergency should arise, we’d be stuck pulling money over from Canada.

The final major hurdle to normal life in the USA for us has been credit. We don’t need credit, or particularly want it, but there’s a limit to what you can do without it. Without a credit history, cell phones are more expensive (if you buy them from a store, but really who does that?), you can’t do things like buy a house, and if an emergency should arise, we’d be stuck pulling money over from Canada.

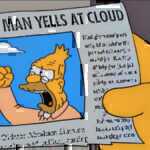

We found out, a couple months after we moved here, that despite having a Canadian credit history, a bank account, an apartment, a job and an SSN, we don’t really exist as far as the US banks are concerned. Applying for even the “pre-approved” offers you get in the mail was futile, because we weren’t in the system. We’re not sure if we’ll ever buy a house in the States, but we’d sure like to have the option available to us!

Finally after a year here, we’ve proved our existence (and income) enough for our bank to extend us a whopping $500 credit card. On one hand this is limiting. On the other hand, it’s great. We really have no intention of going on a shopping spree any time soon, and we’ve gotten so good at living off cash only, that it’s really just a luxury to have it. But what it means is that we get to start fresh with a brand new credit history.

Remember when you went away to college and got your first $500 student credit card, and your parents and friends said “use it for groceries and pay it off as soon as you get home?” Advice that, if followed, would leave you with a powerful credit rating. Raise your hand if you followed that advice… I know my hand isn’t up. I think the first thing I did, 17 and flush with credit, was buy myself a cell phone and a mini disc player — very cool at the time, but I’m pretty sure there’s still a few dollars of that purchase on a credit card somewhere. I wouldn’t say I was horrible with my credit — my rating in Canada is around the average mark, and we accrued less debt between the two of us than 70% of college students. But if I could do it again, I would have been a lot more careful.

And now I can! And by that I mean: Nic will have the credit card, and I’ll continue to sell things on eBay if I want to buy myself a new toy (I’ve already figured out what I’ll have to sell to be able to afford an iPhone). And we’ve vowed to buy groceries with it, and pay it off as soon as we get home…

Congrats Jon. And even with my limited knowledge of credit and cash, being able to live of cash alone seems amazing.